BN9 Business Number and the Nutrient Management Program

BN9 Collection for Nutrient Management Strategies and NASM Plans

NMS and NASM plans will not be considered complete, and will not be placed in the Review Queue, without the BN9 number.

How to include the BN9 number with NMS and NASM Plans

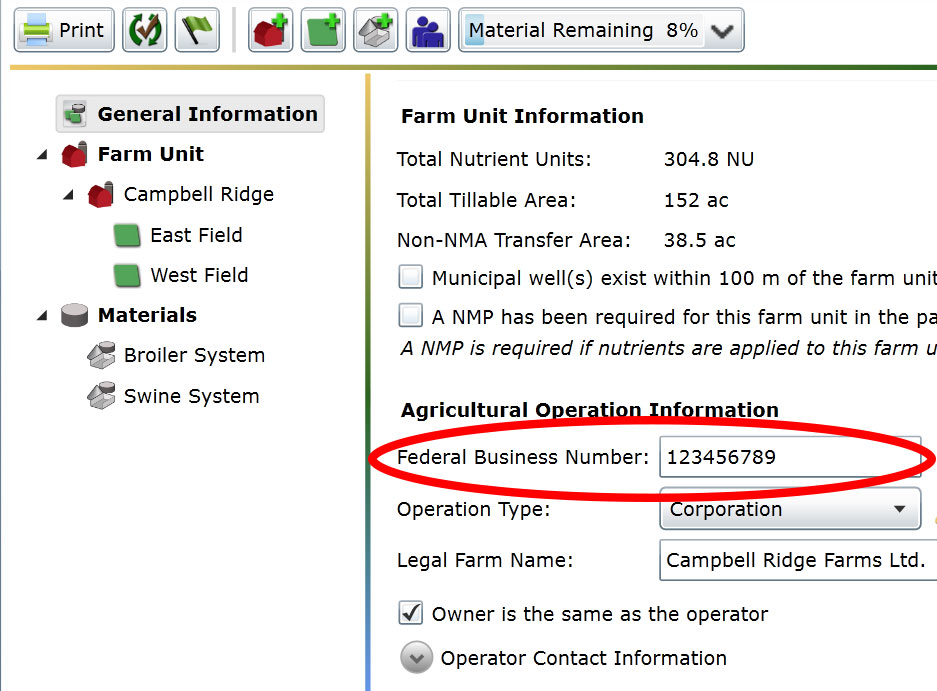

1.) Enter the BN9 number into the “Federal Business Number" field on the General Information Tab of AgriSuite.

OR

2.) Complete the Business Number Collection (BN9) Form.

Note: the proof of Corporation Name (Articles of Incorporation) is no longer needed when the BN9 number is submitted.

Exempt from having a BN9?

You must complete and submit the Business Number Collection (BN9) Form with your exemption confirmation and include with your NMS or NASM Plan.

FAQs

Answers to some of your questions.

The Business Number Expansion Initiative will expand and standardize the use of the Canada Revenue Agency (CRA) Business Number to help the Government of Ontario better serve businesses.

The goal is to have all provincial programs that interact with businesses to begin to collect and use the Business Number.

From a business customer perspective, this means that during any interaction with provincial government programs, the nine-digit CRA Business Number (also referred to as BN9) may be requested.

A BN9 is a unique nine-digit business identification number assigned and managed by the Canada Revenue Agency (CRA). It’s not just a tax number. The Business Number provides a consistent, standardized way of identifying businesses to ultimately make it easier for businesses to interact with government.

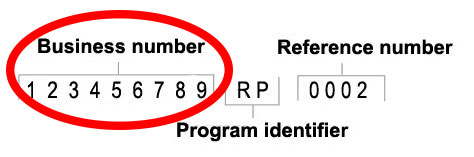

The BN9 is part of the program account number. Each business can only have one BN9, but they may be enrolled in several program accounts, which issue unique program account numbers.

The program account number consists of three parts:

- The nine-digit BN9 to identify the business

- A two-letter code to identify the program

- A four-digit reference number to identify each account in a program a business may have

The Ontario Ministry of Agriculture Food and Rural Affairs (OMAFRA) will be asking for the nine-digit business number only.

Most commonly, businesses can find their Business Number on their GST/HST or Corporation Notice of Assessment, under Notice Details, or GST/HST credit notice. For more information, please visit the CRA’s Understanding the Goods and Services Tax/ Harmonized Sales Tax (GST/HST) Notice web page.

We know government-to-business interactions are not always easy.

Some key concerns include:

- Businesses are asked for the same basic business information repeatedly during multiple government transactions

- Government programs issue different identifiers to businesses during program enrollments/registrations

- Government programs are not able to share business information because there is no consistent business identifier being used

The Business Number Expansion Initiative will promote the use of the BN9 as the common identifier during government-to-business interaction. Our long-term vision is to have a ‘tell us once’ approach. Government programs will be able to refer to a business by its BN9, making it easier to share business information among government programs.

Any business interacting with a government program may be asked to provide their Business Number.

Businesses will have a Business Number if they have registered with a BN9 partner, any federal, provincial or municipal program currently using the BN9 as a common business identifier, such as:

Federal programs, including:CRA tax program accounts such as payroll, corporate income tax, GST/HST, Canada Border Services Agency’s (CBSA’s) or Import/Export program.

Provincial programs, including: Tracking and Reporting Accessibility Compliance, Employer Health Tax, Occupational Health and Safety, Employment Standards, Environmental Compliance Approval.

As a result, the majority of businesses will have a BN9; however, Sole Proprietors earning under the $30,000 gross revenue threshold for GST/HST may not.

If a business indicates that they do not have a Business Number, they can be referred to the Government of Canada’s Business Registration Online (BRO) service to get one.

Businesses can also use BRO to register for any of the four main Canada Revenue Agency (CRA) program accounts: corporation income tax, GST/HST, payroll deductions, and import/export. Links to specific provincial programs are also available to business once they have been issued a BN9.

The following users can apply for a BN9 using BRO:

- a business owner

- a third party requester

- a representative with a RepID or a GroupID

- an individual that employs a caregiver, a babysitter, or a domestic worker

If a business meets one of the following exemptions, a BN9 is not mandatory for OMAFRA programs:

- Canada Revenue Agency (CRA) Business Number Exemption: Businesses are not required by the CRA to have a BN9 if they have no employees and/or earn under $30,000 gross revenue. See the Canada Revenue Agency’s guidelines for more information.

- Religious Exemption: Constitutional exemptions apply for clients who indicate they have a sincerely held religious belief and that securing a BN9 will interfere with that belief.

You will have the option to check an attestation box if one of these exemptions apply.

If a business is exempt and not required have a business number, having a BN9 is still encouraged. The BN9 provides a consistent, standardized way of identifying businesses to ultimately make it easier for businesses to interact with government.

Any business can easily get a BN9 at no cost.

Adoption of the BN9 is guided by the principle of One Business, One Number. This means that every unique business (Sole Proprietor, Partnership and Corporation) will only have one BN9.

Within the lifecycle of a business, there may be situations in which more than one BN9 can be associated with a business. For example, if a business inadvertently registers for two separate BN9s, a duplicate can occur. In this case, once the duplicate is detected, one BN9 will be closed so that the remaining BN9 identifies the business. For more information on the Business Number, please visit the CRA website.

Government staff will not have access to personal information when a business gives their BN9. Staff will be able to see any information the program would have had before plus the BN9 information for this business. This could include:

- legal name

- operating name

- registration number

- operating address

- type of business/structure

- activity type/industry

- owner/contact name

- contact phone number

- email address

- number of employees

Not every business that interacts with OMAFRA will have to give a BN9.

There are many OMAFRA programs that will collect, store and use business numbers. Some of these programs are connected to:

- Registration of Goat Milk Producers

- Deadstock

- Cattle Dealer Licensing

- Livestock Medicines Outlets

- Livestock Community Sales

- Animals for Research

- Apiary Program

- Foodland Ontario

- Meat Inspection Program

- Licensing of Non-Shopkeeper Distributors

- License for the Operation of a Dairy Plant

- The Fish Interim Audit Program

- Agricultural Drainage Infrastructure Program

- Farm Implements Act

- Nutrient Management Act

- Agricultural Tile Drainage Installation Act

You will not need to provide a BN9 until you renew a licence, registration or other agreement with OMAFRA, including transfer payment agreements and grants. There will be an area on the application or paperwork where you can give your BN9 the next time you apply to OMAFRA programs.

Agricorp already collects BN9s, but at this time a BN9 is not required to enroll in Agricorp programs. You may have to provide your BN9 to other service delivery organizations if they ask for it, including program delivery partners delivering Canadian Agricultural Partnership programs. OMAFRA may ask other service delivery partners to collect the BN9, so make sure you have your number handy when applying to OMAFRA-related programs.

At this time, yes. Farm Business Registration Number (FBRN) is established through provincial legislation. The FBRN is mandatory for any business in Ontario that has more than $7,000 in agricultural revenue.

CRA Business Number (BN9) is established through federal legislation. Any business in Canada can voluntarily request a business number.

OMAFRA has the authority to collect, store and use your BN9 under the Business Regulation Reform Act. The act is on the Ontario government eLaws website.

OMAFRA will use your BN9 as the main or additional identifier of your business, and/or to validate business information against CRA records if needed. Each program will record and store BN9s in a searchable database for use by government staff.

Programs may decide to assign specific numbers to businesses that participate in government programs. These program numbers are for that specific program’s use and will remain separate from your BN9.

Still have questions? Contact OMAFRA’s Agricultural Information Contact Centre at 1-877-424-1300 or ag.info.omafra@ontario.ca.

Reviewed 09/22/2023